Social Security Employee Tax Maximum 2025 Calendar. 6.2% social security tax on the first $160,200 of employee wages (maximum tax is $9,932.40; Federal payroll tax rates for 2025 are:

Listed below are the maximum taxable earnings for social security by year from 1937 to the present. The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 is $10,453.20 ($168,600.

Social Security 2025 Calendar 2025 Calendar Printable, For 2025, an employer must withhold: The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Employer Social Security Tax Rate 2025 Maggee, The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2025. 6.2% for the employee plus 6.2% for the employer medicare tax rate:

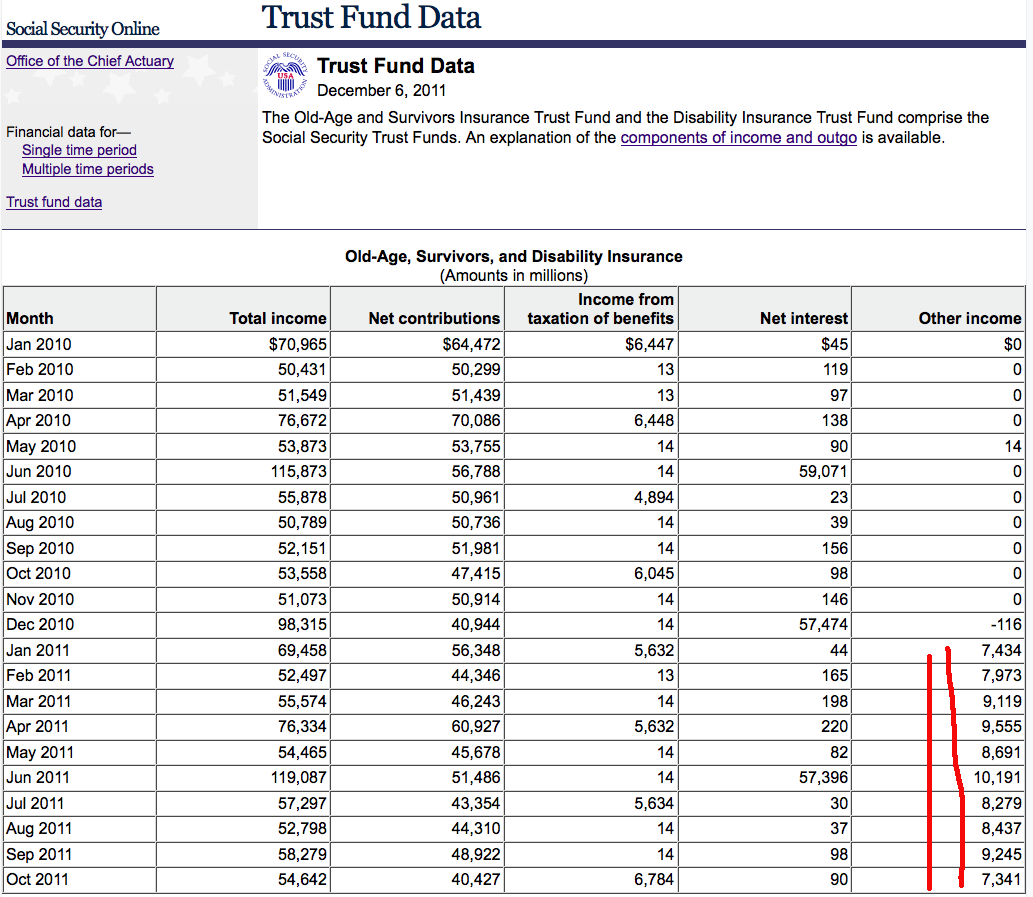

Social Security Employee Tax 2025 Berna Cecilia, For example, if you retire at full retirement. The maximum earnings that are taxed have changed through the years as shown in the chart below.

Maximum Security Maximum Social Security Monthly Payment, The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 is $10,453.20 ($168,600. For employees, the maximum social security tax in 2025 is the product of the tax rate (6.2%) and the maximum taxable earnings ($147,000).

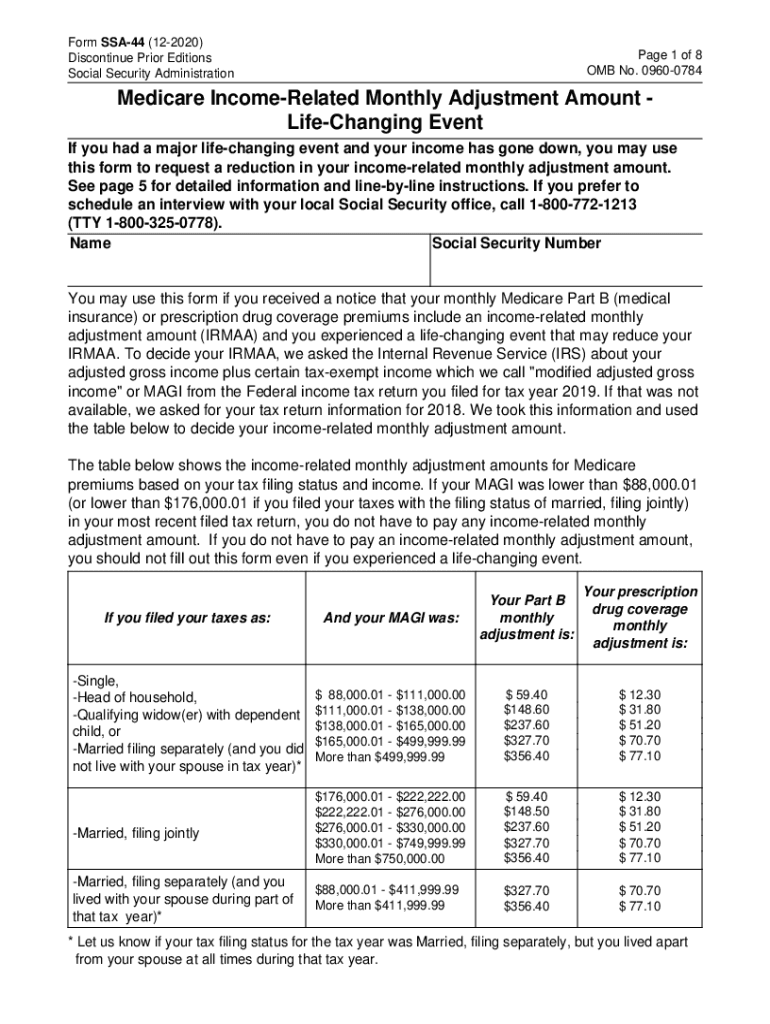

Social security irmaa Fill out & sign online DocHub, The maximum social security employer contribution will. In 2025, the oasdi tax rate is 6.2% for employees and.

How To Calculate Social Security Tax And Medicare Tax, For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). Oasdi tax, also known as social security tax, is collected from paychecks to fund the social security program.

Maximum Taxable Amount For Social Security Tax (FICA), For 2025, the maximum social security tax that an employee will pay is $10,453 ($168,600 x 6.2%). For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025).

Maximum Taxable Amount For Social Security Tax (FICA), The social security administration (ssa) has announced that the maximum earnings subject to the social security payroll tax will increase by $8,400 in 2025. 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security.

Social Security Tax Equation Tessshebaylo, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. For 2025, the social security tax limit is $168,600.

Limit For Maximum Social Security Tax 2025 Financial Samurai, The maximum amount of social security tax an employee will have withheld from. [3] there is an additional 0.9% surtax on top of the.